The firm's share price fell by nearly a third on November 8 following a disappointing Impressionist and Modern art sale in which several high-profile lots failed to sell.

Held on a difficult day in the stock market, Sotheby's evening sale of Impressionist and Modern art in New York on November 7 posted a hammer total of $238.8m (£119.4m) that was well under its $355.6m low estimate.

Of the 76 works offered, 20 failed to sell, including a Vincent van Gogh landscape painted in Auvers-sur-Oise just weeks before the artist died in 1890. It was estimated at $28m-$35m and carried the telltale symbol denoting that Sotheby's had guaranteed the seller an undisclosed minimum price for the work. Three stock market analysts subsequently downgraded Sotheby's rating, and in New York Stock Exchange trading on November 8, the company's shares closed at $35.84, a fall of $14.23 or close to 30 per cent.

Of the 27 'guaranteed' lots, five failed to sell. A further ten sold below low estimate, costing Sotheby's $14.6m according to their third quarter results, released last Friday.

The evening's most expensive painting was Gauguin's Tahitian Te Poipoi but, estimated at $40m-60m, it attracted only a lone bidder (Hong Kong collector Joseph Lau) before it sold at $35m (£17.5m). Generating more competition was Picasso's bronze bust of Dora Maar, sold to the New York dealer Franck Giraud bidding on behalf of an American collector, for $26m (£13m) - a record for a Picasso sculpture.

Sotheby's were candid in their assessment of the results but were keen to blame the pricing and composition of the sale rather than see it as a market wobble following the recent subprime mortgage and equity crisis.

"I'm not ready to read this at all as a correction to the market, which I think, despite tonight, is strong," said David Norman, Sotheby's chairman of Impressionist and modern art. "I know the sale was really difficult, but I see it more as resistance to the aggressive estimates and not so much that the market has turned," he told reporters.

As early as August, both Sotheby's and Christie's abruptly stopped offering guarantees, believing they had committed enough money to these sales.

Sotheby's go into this week's contemporary art sales, a critical test of the art market's strength, carrying yet greater risks. Their November 14 sale, which has a collective estimate of $220m-284m, has guarantees equal to about 78 per cent of the low estimate.

The previous day at Christie's - where Americans took home nearly half the lots - the results made better, if less than stellar, reading. Of the 91 lots up for sale, only 17 did not find buyers. The overall sales total of $350m (£175m), was just above the $348.6m low estimate.

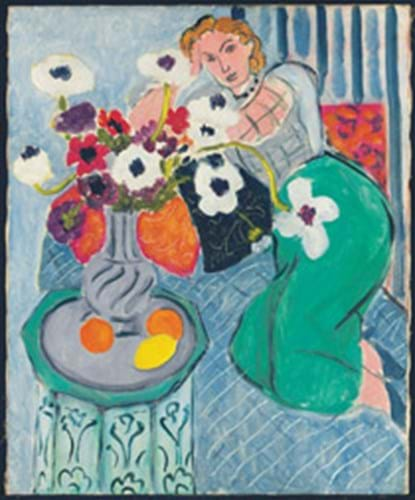

Bidding for the best was competitive, sending L'Odalisque, Harmonie Bleue, a 1937 market-fresh Matisse, to a record $30m (£15m). Seated Woman in a Turkish Costume (Jacqueline), a 1955 Picasso portrait of Jacqueline Roque, being sold by the Nahmad Gallery, was last seen at Sotheby's in 1995 when it sold at $2.5m. This time it brought $27.5m (£13.75m).

By Roland Arkell