Midway through these flagship sales last week there was a sense that the wobbles seen on the world's financial markets would seriously impinge on the art market, possibly triggering a new downturn.

The uncertain bidding that emerged at Christie's evening sale in the Big Apple on November 1 resulted in Sotheby's requesting consignors to lower their reserves before their own sale the following night, something that helped bolster the market even though their offering, which included a $36m (£23.7m) Gustav Klimt, was the stronger of the two sales.

Christie's sale comprised 82 lots, which proved too much for the market to stomach. On the night, 51 lots got away (62%) for a $146.87m (£96.6m) hammer total which was significantly below the $212m-304m estimate.

The biggest casualty was Edgar Degas' (1834-1917) Petite Danseuse de Quatorze Ans, a bronze sculpture which was clearly over estimated and generated no bids. One of around 30 bronzes based on the artist's wax sculpture of a young ballerina, it was guided at $25m-35m. Even the lower level was around 40 per cent above the record £11.8m seen for another version sold in February 2009 at Sotheby's in London.

Pablo Picasso (1881-1973) was among the other big names who struggled here, with only four of the 11 works on offer finding buyers. Most prominently, Tête de Femme au Chapeau Mauve, estimated at $12m-18m, failed to sell.

The top lot at Christie's was a surrealist oil on canvas by Max Ernst (1891-1976). The Stolen Mirror from 1941, painted shortly after the artist escaped from Nazi-occupied France, overshot its $4m-6m pitch and was knocked down at $14.5m (£9.5m) to a European collector. The price was a record for the artist.

Decent competition also emerged for Le Premier Cri, a polished bronze child's head by Constantin Brancusi (1876-1957) conceived in 1917. Estimated at $8m-10m, it sold at $13.2m (£8.68m) to a telephone bidder and was underbid by New York dealer Larry Gagosian.

Sotheby's evening sale on November 2 was a slightly more compact affair with 70 lots, but packed noticeably more punch. With some help from the lower reserves, 57 lots got away (81%) for a $174.8m (£115m) total, which was within the $167.5m-229.8m estimate.

As with Sotheby's Frieze week evening sale in London, the auction took place as a protest was staged outside the premises in support of the locked-out art handlers who are involved in a pay dispute with the company's management.

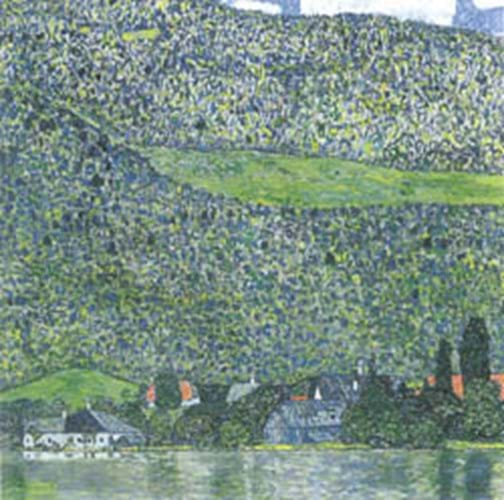

In any case, the highlight of the sale was the Gustav Klimt (1862-1918) landscape Litzlberg am Attersee for which the auctioneers published an estimate 'in excess of $25m'. The picture had been hanging in the Museum der Moderne in Salzburg, Austria until being restituted to the descendants of Austrian iron magnate Viktor Zuckerkandl, from whom it was stolen after the Nazi annexation of Austria in 1938.

Drawing multiple bidders, it was finally knocked down at $36m (£23.7m) to Swiss dealer David Lachenmann on behalf of a collector. This was the highest price of the week and was similar to the £24m seen for Klimt's Kirche in Cassone at Sotheby's in London in February 2010, a painting that had also been stolen from the same Viennese family.

The price, however, was below the level that Mr Lachenmann had reportedly offered the owners in the summer to purchase the picture privately.

The sale also saw a late Picasso, L'Aubade from 1967, take $20.5m (£13.5m) from an anonymous telephone bidder against an estimate of $18m-25m. In addition, a record arrived for Gustav Caillebotte (1848-94) as Le Pont D'Argenteuil et La Seine from 1883 sold to an American collector at an above-estimate $16m (£10.5m).

Sotheby's auction, however, did not include the Henri Matisse (1869-1954) Nu de dos (1er etat) bronze which was withdrawn the day before the sale. One of a group of four lifesize reliefs of female subjects consigned by the Burnett Foundation in Fort Worth which were due to be sold one at a time, it seems a buyer had come forward at the last minute to purchase all four.

The hammer total for the week, including day sales, was $346.3m (£227.8m), compared to $465.5m (£304.3m) for the same series last year.

People will now be holding their breath to see how the more speculative side of the market is affected at this week's Contemporary series in New York.

By Alex Capon