Alongside ample evidence of the continued difficulties in the antique furniture market as a whole, the index recorded a small rise in the stock of Georgian mahogany.

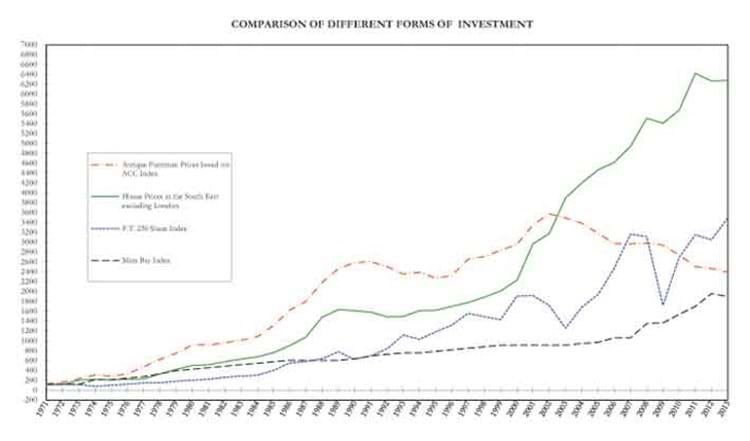

As a whole the index, based on a blend of retail and auction prices for 1400 typical (rather than exceptional) items pictured in John Andrews' book British Antique Furniture, fell by 3% last year. Set at 100 when Mr Andrews began the project in 1968, the Index reached a high of 3575 in 2002 but now stands at 2391, a level it last saw in the mid 1990s.

This reflects falls in six of the seven major categories from which the Index is derived with Oak (-5%), Walnut (-6%) Regency (-5%) and Early Victorian (-6%) pieces all feeling the pinch.

"This year's update of the ACC Index comes at the end of a depressed decade for antique furniture," says Mr Andrews. "Many dealers have closed up shop completely; some of the remaining traders cluster together at fairs like besieged Wild West pioneers in covered wagons.

"On the other hand, in late 2012 reports circulated of improved sales of antique furniture and the fashionable disdain for Georgian-style mahogany seems to be dissipating."

Mahogany Market

Early Mahogany, a category based on good-quality, middle-range pieces made between 1730 and 1760, during which the reputation of English furniture was established, rose 3% in 2012.

While large amounts of Victorian and Edwardian mahogany furniture continues to be discarded cheaply at auction (the separate Victorian & Edwardian index registered another double-digit fall at -14%), the Late Mahogany (c.1760-1800) category also fared relatively well, registering only a small drop (-1%) - and this despite the continued decline in formal dining furniture and the fall in demand for pieces too bulky for the modern interior.

"The latter part of 2012 had some cheerful signs of better activity and optimism about the market. It is still not possible to conclude that a substantial recovery is imminent, but the mahogany furniture that took so much criticism over the last decade is now being viewed with much better understanding," says

Mr Andrews.

"The sneers at dull brown furniture are ignored by people simply furnishing, not necessarily collecting or investing, to whom much good robust furniture is available at attractive prices."

Certainly, as so much antique furniture is now affordable, there are signs that the rate of decline may have slowed and the modest drop recorded in 2012 comes in the wake of much larger falls in 2011 (-7%) and 2010 (-6%).

A fuller analysis of the numbers is published in the February edition of Antique Collectors' Club magazine Antique Collecting.