That's a 12%/17% rise year on year and the biggest total in history for a single company within the international art market.

Jussi Pylkkänen, newly appointed as global president, told ATG that the 18% increase in spending across the world by buyers from Asia - accounting for 27% of all sales - was "very, very meaningful" and, for him, the stand-out statistic among Christie's results.

It's not just the amount of money they are spending but how they are spending it that matters, he says. "They are moving on from buying just Asian art to new categories: Impressionist and Post-war art, jewellery and even European furniture."

It is this development in taste that Mr Pylkkänen believes could bring about a revival in relatively dormant collecting markets, helping to balance out more the dominance of Contemporary, Post-war, Impressionist and Modern art.

Chistie's Results At A Glance

Total sales: £5.1bn/$8.4bn 12%/17% increase

Auction sales: £4.2bn/$6.8bn 10%/15% increase

Private sales: £916.1m/$1.5bn 20%/26% increase

Online sales: £21.4m/$35.1m 54%/60% increase

After the recent upheaval of former CEO Stephen Murphy's departure, Mr Pylkkänen said there would be no radical changes at Christie's in 2015. Instead the company would be focusing on capitalising on what he called the "tremendous level of energy" in the art market, spread across auctions, private sales and the eCommerce platforms.

Mr Murphy had had a three-year plan, which he had executed, and so had moved on, he said, emphasising the extension of the Christie's brand into China and India during that period.

Private sales, up 20% in sterling terms at £916.1m and 26% in dollar terms at $1.5bn, now make up almost 20% of all transactions at Christie's. Mr Pylkkänen firmly rebutted the notion that this trend contributed to making the market less transparent.

"Selling works of art across the globe between key clients makes sense and has always been part of the business. Dealers do an incredibly important job in this regard. And we play a central role in being transparent through our auction sales."

Together with the development of online auctions and the availability of results at every level, he felt that Christie's provided a "benchmark" when it came to the transparency issue.

Other Headline Statistics

• Post-War & Contemporary art up 33% at £1.7bn/$2.8bn

• 30% of buyers were new to Christie's in 2014

• 42% of new buyers online were aged under 45

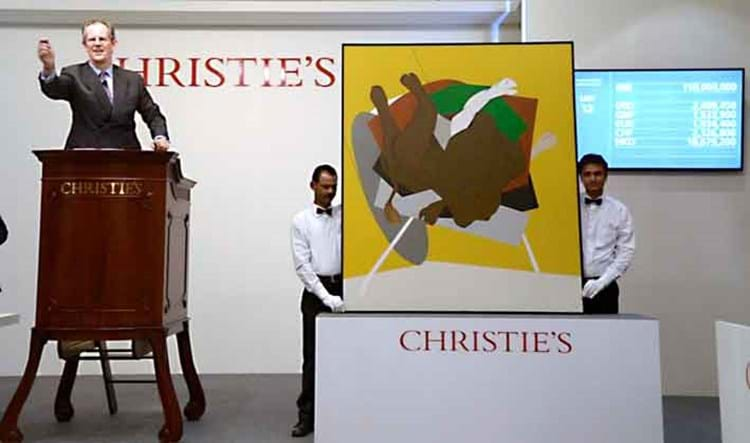

• £1.53m/$2.4m: the highest price paid live online via Christie's LIVE (for Tyeb Mehta's (Untitled) falling Bull) in Mumbai in December

Mr Pylkkänen also welcomed what he saw as a "much more transactional" marketplace, with new collectors buying and selling much more regularly as their tastes developed, releasing capital for investment and bringing new business to both dealers and auction houses as a result. This is particularly noticeable where Contemporary art collectors sell works and then reinvest in newer, cutting edge artists like Peter Doig, he said.

And he credited the emerging fairs such as Frieze with bringing more people to the marketplace.

"There is more footfall at the fairs and auction houses and this is mirrored in general internationally. Now you have people in their 30s and 40s buying art."

Mr Pylkkänen said the company were monitoring the effects of the recent Swiss currency crisis on business at their Geneva and Zurich rooms, but added that it was too early to say what impact they might have.