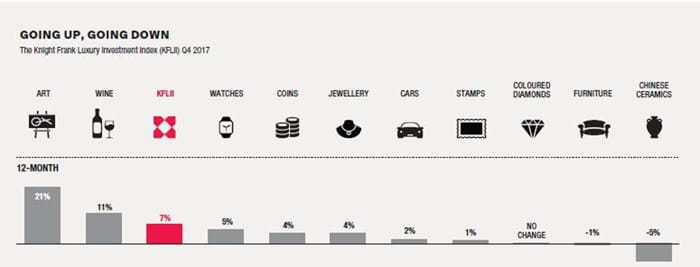

The average value of art sold at auction rose by 21% during the year, beating wine which rose 11% according to the Knight Frank Luxury Investment Index in 2017.

In previous years art lagged behind asset classes such as classic cars and wine in the Knight Frank Luxury Investment Index (KFLII). Last year wine was the top-performing asset class with growth of 24%.

The performance of a handful of record-breaking sales at auction propelled art to the top of the class.

The major drivers behind this growth were Christie’s sale of Salvator Mundi by Leonardo Da Vinci for a premium-inclusive $450m and Jean-Michel Basquiat’s Untitled at Sotheby’s which sold to the Japanese collector Yusaku Maezawa for $110.5m– a record for an American artist.

Knight Frank’s report is put together with data from a number of sources such as art auction data from Art Market Research (AMR).

AMR director Sebastian Duthy said: “As prices for the very best 19th and 20th century art continue to hit the headlines, there is hope within the industry that the sensational Da Vinci sale could attract a wider audience to Old Masters in 2018."

Art market reports should be viewed with caution as outliers such as these results distort the overall figures and are often not reflective of the wider market. But Knight Frank acknowledged that these two headline-grabbing sales were extreme and argued that “the wider art market also performed very strongly”.

Duthy added: “Volatility in the art market has been driven by prices of post-war and contemporary art in the last few years. After a depressed market in 2016 caused widespread concern, consignors were tempted back by auctioneers last year.”

The Knight Frank index found that over the 12 months to the end of 2017, luxury watches rose 5% and classic cars were up 2%.

The worst performer of the index was Chinese ceramics, down 5%.

Antique furniture continued to underperform and was down 1% over the year. However, Knight Frank acknowledged that “even furniture has the power to defy expectations when pieces with the right provenance catch the imagination of buyers”. The report cites a set of four 16th or 17th century Chinese huanghuali folding chairs that sold at Bonhams for a hammer price of £4.5m as an example of a record price for furniture.