Ivory consultation launched

There are relatively few issues around which most dealers, collectors and auctioneers can find common ground. But ivory is one of them.

A blanket ban on the sale of antique ivory of the kind mooted in 2017 by celebrities, parliamentarians and conservationists alike would impact businesses large and small – from the humble stall at a showground fair to the carpeted, gilded halls of TEFAF.

Pantomime

The ivory debate had its near pantomime moments this year, underlining once more that CITES can create legal knots. In February, it required 10 officers to raid the premises of a clock dealer selling a Victorian barometer fashioned from an ‘unworked’ tusk.

Every newspaper was keen to carry the story of an ivory gong removed from display at Sandringham House in April, on the grounds that, as an entrance fee was charged, it was being used for commercial purposes.

“The year started hopefully for ivory with much positive energy at ATG’s Seminar on CITES event in Westminster

The year started hopefully for antique ivory, with much positive energy at ATG’s Seminar on CITES in January. In February, national media picked up the Gazette’s story on support from well-known faces for the continued trade in antique ivory.

However, since then it has proved more difficult for the trade to be heard on its core message – that antique ivory is no threat to current elephant populations.

In November, as the consultation got under way, a group of leading trade figures were invited to make their pitch to MPs – proposing for the first time (in public at least), the idea of an ivory licensing scheme.

It is a bold concession, and one that gives the British government the opportunity to take a sensible ‘third way’ on the ivory issue, but it could yet prove to be divisive.

Charging a fee to ‘approve’ an ivory work of art would create the natural economic filter that would do away with most of the problematic post-war ‘trinkets’ that continue to surface at markets and regional auction houses.

Would it not, however, also have the effect of preserving the market for the top end of the trade while shelving it for those lower down the food chain?

ASA rules on buyer’s premium transparency

In response to a single complaint in 2016, advertising regulatory body the Advertising Standards Authority (ASA) was asked to consider whether estimates in auction catalogues are misleading if they fail to either state or include the buyer’s premium alongside the guide price.

After a period of investigation – the ASA had to quickly familiarise itself with art market auctions – it issued guidance in March on how auctioneers should properly present their commission rate.

The Advertising Standards Authority investigated whether the level of buyer’s premium should be published directly alongside estimates.

The demand that all quoted prices “must include non-optional taxes, duties, fees and charges that apply to all or most buyers” met a mixed response.

Some welcomed the increased transparency, others deemed the ASA solution as, at best, inelegant.

Toeing the line

Ultimately most auction houses have toed the line with relatively little upheaval in practical terms.

Typically it has now become common practice to locate the buyer’s premium next to the estimate, and insert an asterisk beside the buyer’s premium linking to information on any other charges, such as the Artist’s Resale Right.

As for the top three auction houses, Bonhams promised it “will be fully compliant with the ASA guidelines” and, with a note on each catalogue page, it has been. Christie’s and Sotheby’s, on the other hand, appear to have made fewer concessions.

“Until a precendent has been set it is still unclear exactly what changes have to be made

To determine the meaning of all manner of symbols indicating if an item is, for example, subject to a guarantee, owned by the auction house, subject to or being sold from a vendor outside the EU, buyers still need to check the small print of the terms and conditions.

Sotheby’s said its catalogues “currently include extensive information on the areas that the ASA guidelines focus on”.

Of course, the ASA has produced guidelines, not statutory law.

As Helen Carless, chairman of SOFAA, says: “Until a precedent has been set with another complaint, it is still unclear exactly what changes have to be made.”

Closure of Christie’s South Kensington

If ivory dominated trade discourse in 2017, then the demise of Christie’s South Kensington pushed it a close second. The preamble phrase ‘with the closure of CSK…’ became hackneyed in the market this year.

To recap, rumours that CSK – the last tangible link between Christie’s and the grassroots of the antiques trade – might be surplus to requirements had been circulating for years. However, it was still an ‘end of an era’ moment when the announcement was made in March and the final sale held in July.

Christie’s UK chairman Orlando Rock told ATG the closure “has been a very painful decision for all but for the long-term health of the business it is right”.

Witness the sale of a single picture later in the year for $400m – Leonardo’s Salvator Mundi – and that cold logic becomes clearer.

Few celebrated the demise of another of London’s middle-market salerooms – only Bonhams Knightsbridge now survives to remind of an older, more inclusive, era – but opportunities were knocking.

Rebirth of ‘CSK’

Auctioneers inside and around the M25 looked to capitalise on the momentary availability of talent (see page 20) and the chance to snare at least some of the 10,000-plus lots that CSK would no longer be selling.

Chiswick Auctions made the biggest play, opening a showroom manned by former Christie’s staff on the Fulham Road. The business is called Chiswick at South Kensington, providing an acronym easily recognisable to London’s auction regulars.

Just how big any vacuum turns out to be will depend on how much business slimmed-down Christie’s chooses to leave behind.

Last month it held the first King Street ‘entry level’ Interiors sale, part of a three-tier repackaging of the decorative arts calendar that promises a far more selective approach to consignments.

The signs are it’s all to play for.

BAMF gives its Brexit assessment to government

While in December came the worrying revelation that the UK government had yet to analyse Brexit’s potential impact on the wider economy, six months earlier the art market had completed a Brexit assessment of its own backyard, together with a wish-list.

At a time when many people were enjoying their summer holiday, in July British Art Market Federation (BAMF) chairman Anthony Browne was presenting the UK’s art market hopes and needs to government.

BAMF’s evidence and arguments were contained in its latest art market report, on topics including UK/EU trade, VAT, Artist’s Resale Right, cultural legislation and EU citizens/overseas visas.

As Browne told ATG: “We are embarking on a particularly challenging period and we wanted to make sure that government was aware of our significance in terms of jobs, economic generation, tax and the fact that we are a globally successful sector.”

Given how arduous and complicated the wider Brexit negotiations are proving, what makes Browne think government will listen?

“With an overall value of £9.2bn ($12bn), we are the second-largest art market in the world and a British success story, and we have the data to show why the government should bother with us,” he said.

‘No room for complacency’

“But global competition is increasing, particularly with the rapid growth of China (the BAMF report calculates that China has 20% global share with 21% for the UK).”

When Browne reminds us that there is “no room for complacency”, he is no doubt thinking of some sobering statistics. For although the UK has managed to hold its own in the global rankings, in the 10 years to 2016 UK art sales have fallen by 18%, in a period when global sales advanced in value by 4%.

Fake news: Mod Brit art fakery grabs headlines

The issue of fakes is a perennial one. But if 2016 was the year that the Old Masters and French furniture scandals led the news agenda, then 2017 brought Modern British art into the headlines.

If there were any lessons from this year’s cases, it was that relying on a single expert’s opinion may not always be enough. In particular, failing to research works properly after being informed of any doubts could land a dealer or auctioneer in trouble.

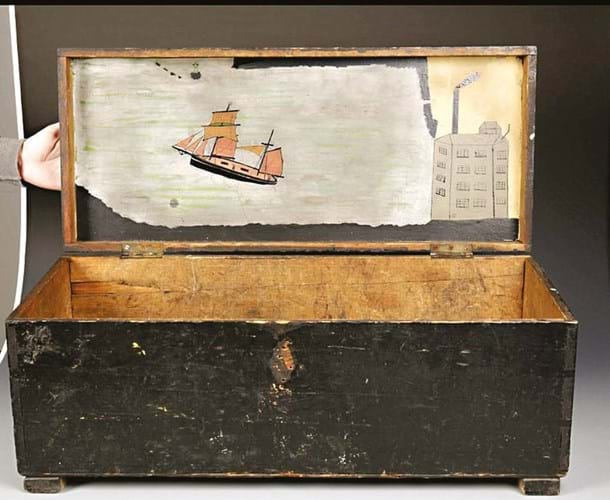

A cautionary tale came in Dorset this year when the local trading standards body seized what were later shown to be Alfred Wallis fakes. Duke’s said the paintings had been approved by Edward Mullins, a leading Wallis scholar.

However, when the case came up at Weymouth Magistrates Court in October, it was deemed that Duke’s had failed to take reasonable steps to follow up doubts expressed regarding the veracity of a Cornish attic ‘provenance’ and a Wallis family connection. The auction house pleaded guilty to the charges and was ordered to pay £18,275.

Among the works purportedly by Cornish artist Alfred Wallis (1855-1942) that were seized at Duke’s was this Victorian pine tool chest, decorated on the inside of the lid with a brigantine leaving Hayle harbour. It had been pitched at £20,000-40,000.

In January, a man from Sunderland who forged the work of mining artist Norman Cornish over a two-year period was jailed after deceiving a gallery into paying £52,500 for a group of 14 pictures.

Richard Pearson’s creation of fake 1960s receipts from Cornish’s former dealer The Stone Gallery in Newcastle would be his downfall. He had quoted prices in decimal currency rather than pounds, shillings and pence.

The year in quotes

“We start from the position that the current legal trade helps facilitate the illegal trade in ivory"

Michael Gove, secretary of state for environment, food and rural affairs, as the government began the ivory trade consultation

“All the deals we did last year were done through relationships. Buyers hadn’t visited the gallery"

Johnny Van Haeften, one of clutch of dealers pushed out of St James’s, relocates his gallery to his home in Richmond

“The antiques trade should make their views known or we are looking at the end of 700 years of UK hallmarking history"

John Langford of the British Hallmarking Protection Alliance fights a rearguard action against the practice of British hallmarking overseas

China’s rise – but the usual caveats remain

Records for Chinese works of art continued to tumble, proof that, at least at its upper echelons, the market remains in rude health. Qing magnificence still rules – crowning London’s Asian art auctions in the spring was a splendid pair of Qianlong (1736-95) famille rose ‘butterfly’ double-gourd vases sold at Christie’s for £13m – but in 2017 the best early wares proved more than a match.

The Kuroda family ‘oil-spot’ tea bowl, a Song dynasty (960-1279) survivor from the Jian kilns, was the prized lot of the Linyushanren collection, selling at Christie’s New York for $10.3m (£7.9m).

An 11th century celadon brush washer from the fabled Ru kiln in Henan – one of only four Ru wares in private hands – was expected to surpass that sum at Sotheby’s Hong Kong in October and it did. It was knocked down at HK$260m (£24.9m), a record for any Chinese ceramic.

Classical furniture from the Ming dynasty is also on a roll – a set of four Ming huanghuali folding armchairs and a pair of tapering cabinets selling for £4.5m and £1.6m at Bonhams in November – but a few rungs down the ladder, the wider issue for western auctioneers is undoubtedly one of supply. Buying opportunities still abound across the thousands of lots offered on a monthly basis, but there’s no doubt sales are thinning.

This is not a market without challenges. For one thing, issues of non-payment and other financial shenanigans refuse to go away. In 2017 stories of ‘purchases’ by buyers in Asia, that end up not being paid for, continued to circulate.

No longer should such things come as a surprise. Suggestions in the recent Global Chinese Art Auction Market Report that the market in mainland China and Hong Kong had grown to $4.8bn were countered by a key detail in the small print. Just 51% of items were actually paid for.

Online only from the ashes of Auctionata

The year began with another inauspicious moment in the brief history of ‘online-only’ fine art auctions. Auctionata and Paddle8, two market-leading firms in this field, became insolvent.

Just six months earlier, in the words of co-founder and former CEO Alexander Zacke, it had “made sense to join forces as you close in on the summit”. New York-based Paddle8 lived to fight another day. Berlin-based Auctionata didn’t.

For many, the internet has become the first port of call in the search for art and antiques for sale. Yet when it comes to the online-only auction model, failures have so far been more common than success.

However, 2017 might just have been a tipping point. It was the year when mistakes were learned and when Sotheby’s and Christie’s dipped a foot, rather than just a toe, in the water.

Christie’s has made the bigger strides – a factor in the closure of its second London saleroom. Sell-through rates of 81% across the first 35 online sales of 2017 left global president Jussi Pylkkänen comfortable with the pace of progress.

As Pylkkänen said: “In the 1970s, the best way of creating audience volume was with a saleroom like South Kensington. Now, with online searching, that is not the case.”

Return to first principles

Some good-quality, market-fresh consignments, offered with attractive estimates, have helped Christie’s in this regard. Too often, those first principles of a successful auction were forgotten as the business courted its new online audience.

Who could possibly have guessed that the digitally savvy buyer with access to eBay, Artnet, Watchfinder and thesaleroom.com’s Price Guide would be so well informed when it came to current price trends?

Perhaps the online-only sale doesn’t need to be seen as a ‘disrupter’ in the art and antiques field. Its fundamental appeal to bidders is as a convenient way to bid at auction – and for sellers, as a way of widening the bidding audience.

In August, Sotheby’s – its fingers financially burnt during the first dot-com boom – upped the ante in the digital auction space by scrapping buyer’s premium for an embryonic digital sale programme.

Forgoing fees on 30 or so ‘low-value’ sales is unlikely to cripple the bottom line, while the hope is for higher hammer prices and a new generation of customers.

The battle for our ‘cultural heritage’

Most antiquities dealers would support the idea of an amnesty – a chance, in the words of Joanna van der Lande, chairman of the Antiquities Dealers’ Association interviewed in ATG, to “draw a line under everything not proven to have been stolen”.

However, few events in 2017 suggested the wind is blowing in that direction. What passes for acceptable provenance is moving backwards, not forward in time.

The case study of the so-called Guennol Stargazer ‘sold’ for $12.5m in April is important.

Christie’s said the Republic of Turkey’s claim to own this ancient Anatolian idol, which has been on American soil for over half a century, sets “a disastrous precedent for collectors, museums and the art market”.

Antiquities with long western histories were also seized at Frieze Masters and at TEFAF NY.

At a time when antiquities provide some of the most exciting visual draws at international fairs, a ‘guilty until proven innocent’ attitude to their sale is fast emerging.

An accepted narrative is that the smuggling of works of art from conflict zones is a growing problem, although the claim is unproven. Operation Pandora, designed to clamp down on illicit trade in cultural property within Europe, concluded this year, having turned up little of consequence.

Despite this, the EU is conducting an extensive consultation exercise into further restricting the movement of ‘cultural objects’ – a definition wide open to interpretation – that could cripple the legitimate international trade.

Some idea of how this might pan out can be seen in Germany, where, since August 2016, sellers of ‘cultural goods’ have been asked to provide proof of at least 20 years of provenance – including export licences from the country of origin. Typically, this kind of paperwork is just not available.

Dealers at the Munich international coin fair in March became the first citizens to be charged under the Kulturschutzgesetz, after which auctioneers Nagel and Lempertz followed through on threats to move Asian art sales out of Germany to Salzburg and Brussels.

German trade bodies are hopeful that the law might be revised and politics – the need to form a working coalition in the wake of the recent elections – might just help.

Landscape of London’s fairs continues to shift

Two decades ago the Olympia complex was the key location in the London fairs calendar, hosting both a series of ‘barometer of the trade’ antiques fairs alongside the annual London International Antiquarian Book Fair. But the sands have since shifted.

In June the Antiquarian Booksellers’ Association held its last event at the Kensington venue. Next year it moves to Battersea Evolution (home of the ever-popular Decorative Antiques and Textiles Fair) where organisers feel they will have “more success” encouraging “wealthy people to go shopping for rare books”.

Then, in October, came the sudden – if not unexpected – announcement that the Winter Art & Antiques Fair Olympia was no longer financially viable. Organiser Clarion has floated the possibility the longstanding event could continue in a reduced format, but the end after 27 years is surely nigh.

The summer Art & Antiques Fair Olympia remains. Clarion’s new London Art Antiques & Interiors Fair at east London’s ExCeL centre will be reprised in January, while bijoux event BADA Collection at The Lanesborough in Hyde Park Corner will return in October 2018 after its debut this year.

More Masterpieces

The art and antiques fair success story has been Masterpiece, based in its luxury tent at the Royal Hospital Chelsea. In terms of finding its target audience, the fair came of age in 2017, its eighth year.

Earlier this month, Art Basel owner MCH Group purchased a majority stake in the event with plans to take the brand to other key global markets.

The possibility of a rivalry with the TEFAF brand, now fully ensconced in New York as well as committed long-term to Maastricht, is surely a healthy development.

There are those who contest that the traditional fairs model is due a change, so too the established shop or centre way of dealing.

Accordingly, excitement attended plans for a new London art hub in South Kensington’s Cromwell Place.

The centre, due to open in autumn 2019, offers galleries, offices and tailored support for art businesses of all sizes. First-round applications for space opened in October.

Dealers fight back on business challenges

The British trade associations scored a significant victory in 2017.

The subject of quarterly reporting may have lacked the emotional punch of ivory or the great unknowns of Brexit, but it too had the potential to create havoc for the many members of the dealing community whose annual income is subject to seasonal peaks and troughs.

After vigorous lobbying by BADA and other small business bodies, quarterly reporting (planned for 2018) was axed from the Finance Bill in June.

There are hopes the scheme will now be shelved altogether.

Sharing e-commerce

The need for a strong voice on pressing business issues meant that, for the first time in recent memory, the possibility of a merger of the two dealer trade associations was discussed seriously, openly at ATG’s round tables and in our Letters pages (see page 26).

One often-put argument for unity is a desire for a combined e-commerce platform for the UK trade.

There has been much disquiet since powerful online portal site 1stdibs chose to change the way it displays objects for sale as part of “a number of site upgrades designed to streamline the buyer experience”.

The names of individual dealers are no longer shown next to the items for sale and buyers can see who is selling the item only once they have initiated discussions to buy.

Of course, 1stdibs is due the commission on sales initiated through the site. But is this an environment that allows the time-honoured dealer-client relationship to prosper?

Dreweatts and the end of the Gibbons saga

The four year-long saga of Stanley Gibbons plc and its ‘interiors division’ plumbed new lows in 2017. You really could not have made up the tale’s various twists and turns.

Mark Law’s attempts to buy auction house Dreweatts and its Stanley Gibbons’ sister company, Mayfair-based dealership Mallett, was the talk of the trade in May and beyond.

Law had agreed to a £2.4m purchase – even reintroducing weekly general sales at Donnington Priory after receiving the keys – only for the deal to collapse in August as his financial backer walked away. Gibbons says a termination fee is now payable.

A white knight

Fortunately for cash-strapped Gibbons – and Dreweatts staff members hoping for security – other potential buyers were waiting in the wings.

With the sale of Dreweatts for £1.25m in October to valuation and consultancy firm Gurr Johns, one of the UK’s best-known regional fine art salerooms has the chance for a clean slate. This time the match looks a good one with Gurr Johns potentially a great feeder of merchandise.

Elsewhere, difficulties for Stanley Gibbons were far from over. Mallett, bought for close to £8m in 2014, has now all but disappeared after a final stock sale while Bloomsbury Auctions (a brand now owned by Gurr Johns) has held what looks like its last sale.

In November, Stanley Gibbons announced a subsidiary ‘investment’ arm was going into administration. Shares that once traded at over £3 are now about 3p.

The year in quotes

“Just as the art trade was improving here, along comes Brexit"

Ian Whyte of Dublin auction house Whyte’s anticipates trouble ahead for the Irish art market

“Antiques are a happiness investment. They create a happy home"

Pele-Mele, dealer, standing at the Foire de Chatou, France’s largest brocante

“The money men have said two salerooms in the city no longer makes sense. But it sends a poor message. Not everyone is an Asian billionaire"

London art dealer James Roundell of Dickinson responds to the news that Christie’s South Kensington is to close

“The discussion became very emotional and then the other side disregarded most of the practical arguments"

Rupert Keim of Munich auctioneer Karl & Faber explains how the controversial cultural heritage bill was passed in Germany