So how fares the trade in Asian art, as we head into another London season of auctions and dealer events? To help us understand the bigger picture for this year’s supplement, we quizzed experts and trawled through auction sales data, the market’s reliable bellwether.

In a nutshell, if 2016 was a year of uncertainty, following the Chinese stock market crash of 2015, then 2017 (so far) feels like a return to steadier trading.

In our market overview dealers and auctioneers note that the investor buyer rather the connoisseur collector is in the driving seat, more likely to be bidding from Hong Kong and mainland China than London or New York.

A dwindling supply of quality objects and the rising tide of fakes are increasingly acute challenges. So little wonder that single-owner collections, with their promise of copper-bottomed provenance, were sell-outs in the past 12 months. Auctioneers tell us they are fighting hard for the chance to sell these collections.

Meanwhile the sale of objects with natural history components – ivory and rhino horn carvings especially – is more legally challenged than ever before.

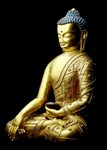

Chinese art remains the strongest performer, as our Hammer Highlights selection attests. High quality Buddhist items and imperial Qing, Yongzheng and Qianlong ceramics retain their allure.

Yet while the vogue may be imperial, modern and contemporary, we have picked out areas that provide delight for the collector, thanks to objects’ intriguing back stories and relative affordability.

Rising stars

The delicate issue of succession looms large over Asian art businesses. We explore how expertise is being passed from one generation to another (‘Gathering Moss’, ‘The Next Generation’) to create a new cadre of Asian art professionals with an in-built will to survive, no matter what the economic prognosis.

Noelle McElhatton

Editor, Antiques Trade Gazette