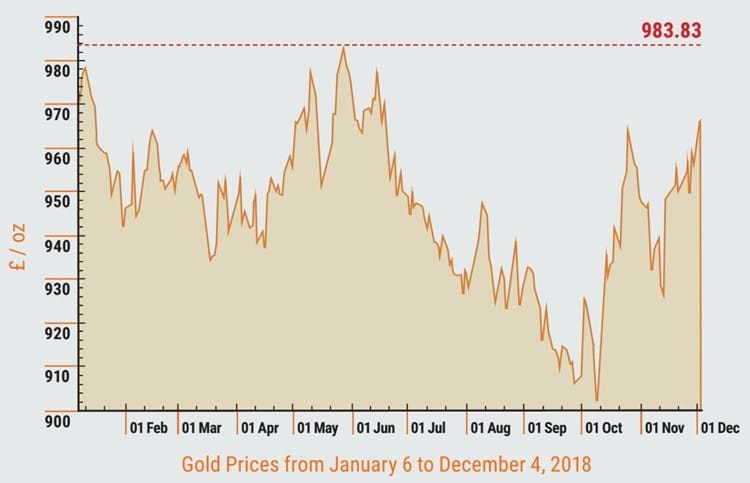

"If we cannot achieve a satisfactory Brexit and the UK is subjected to economic stress, then history will repeat itself and people will go for the safe haven of gold. Taking into consideration the latest predictions from the Bank of England that a hard Brexit could weaken the pound and, as gold is always quoted in dollars, the yellow metal could well become a lot more expensive in a relatively short period of time, especially if we crash out of the EU.

"It’s also worth bearing in mind that low interest rates tend to act as an accelerant to the gold price.

"Looking outside the UK, the fact that many other countries with fast-growing economies have a high desire to acquire gold, especially China and India, means the underlying global demand is increasing.

"We are living through very fluid and volatile times and I’m sure there will be many twists and turns in the markets this year, both before and after the conditions of a final Brexit withdrawal are finally sealed."