Leonardo: The trickle-down effect

No prizes for guessing which single lot commanded the highest price and most attention at auction in 2017. Leonardo da Vinci’s Salvator Mundi drew more media coverage than any work of art ever sold. It was knocked down at a staggering $400m ($450m with premium) at Christie’s New York in November and is now on its way to the Louvre Abu Dhabi.

But does the remarkable price for the picture – the merits of which were much discussed both before and after the sale – have implications for the art market in general?

We believe it does – but perhaps not in the way some observers have suggested.

Two phone bidders pushed up the price of Salvator Mundi as they battled it out for the Leonardo painting until it was eventually knocked down at $400m ($450m with premium). Photo copyright: Christie’s Images 2017.

1. Cross-selling

With the Old Master market continuing to be affected by issues of supply and selectivity, it is unlikely that one enormous price paid by a Middle Eastern buyer will rejuvenate this market.

Christie’s unorthodox decision to offer Salvator Mundi in its Post- War and Contemporary Art sale is perhaps more significant. That raised eyebrows, as, in a similar vein, did Sotheby’s inclusion of Michael Schumacher’s Formula One Ferrari in its equivalent contemporary art sale in November, where it took $6.7m.

“Trophy lots in any discipline are now treated differently

After decades of splitting markets into a series of defined niche categories, such cross-selling is a shift in tactics by the big two. ‘Trophy’ lots in any discipline are now treated differently. Already adopted in high-end decorative art sales such as the Treasures and Exceptional auctions – and in Sotheby’s 2017 themed sales such as Erotic: Passion & Desire and Actual Size – cross-selling has now been tested with some notable results in the fine art market.

It seems logical to predict more high-calibre items will be offered in this way. “The Leonardo was – to date – an exception and innovation rather than a trend,” says Dirk Boll, a Christie’s president.

However, “bringing together the ‘best of type’, whatever the category, reflects the eclectic collecting habits of savvy and powerful collectors today, who are less bound to a certain period, but search for the highest quality across categories”.

The portrait of Anne of Hungary’s court fool, Elisabet, by Jan Sanders van Hemessen (c.1504-56), a 19½ x 16in (49 x 40cm) oil on oak panel that sold at Sotheby’s in July at £1.8m. The auctioneers said the intriguing work chimed with a taste beyond the traditional collecting field. “Our clients are not worried by the weird” and are “less concerned with art matching their sofas” commented Sotheby’s worldwide co-chairman of Old Master paintings, George Gordon.

Sotheby’s deputy chairman of Europe, Mark Poltimore, says that while there is “plenty more gas left in the tank for our traditional selling categories”, he agrees it is now important to consider offering unusual and important works in sales outside their usual context.

“We’re happy to sometimes do this if we think it’s appropriate, as we did with the Formula One car,” Poltimore says. “This year may bring some stimulating juxtapositions.”

2. Guarantees

The vendor of Salvator Mundi, Russian billionaire Dmitry Rybolovlev, and Christie’s itself, were not the only parties to make a large sum of money out of its sale.

The picture was backed with a third-party guarantee – meaning someone had agreed to place an ‘irrevocable bid’ of around $100m in advance of the sale.

In return for giving the vendor the security of a minimum price, the guarantor will likely have received a percentage of the hammer price due on the excess.

In the case of the Leonardo guarantor, they are believed to have made something in the region of $25-50m – undoubtedly the largest amount an irrevocable bidder has ever received from a single transaction.

“The race to win CSK merchandise will be a marathon

The practice of guarantees is nothing new in the art market – it was first adopted back in 1971 – but the level of return here for all sides is likely to encourage it further, including in the Old Master market where previously the practice was comparatively unusual.

Expect more competition over guarantees, especially on trophy lots.

3. Mid-market battle

The stratospheric price of the Leonardo seems to symbolise the onward march at Christie’s towards the highest levels of the market.

There are perhaps few lessons here for those lower down the food chain – but in the middle market competition is equally fierce. The fall-out from the closure of Christie’s South Kensington in 2017 will certainly continue deep into 2018.

The race to win the merchandise Old Brompton Street leaves behind will be a marathon rather than a sprint. It will be won in the time-honoured ways of client relationships and quality service and not on a first-come, first-served basis. But, no doubt, some auctioneers are quicker to put in the phone calls than others.

Of course, the big challenge for any London newbie will be to tap into the international ‘little black book’ that was CSK’s buying audience. With that in mind, we expect the merchandise will be spread piecemeal without a dominant player.

Ivory: Cautiously confident

Now the consultation period is over, where will antique ivory be in 12 months’ time? Not, we sincerely hope, subject to the sort of prohibition that will do little to save the plight of the African elephant while preventing the free trade of so many historic works of art that just happen to contain ivory.

There are, on balance, reasons to be confident that the ‘total ban’ mooted in 2017’s media headlines will prove to be a step too far for secretary of the environment Michael Gove.

For example, a number of animal welfare groups are seemingly comfortable with the idea of a ‘de minimis’ exemption that would allow the sale of those objects that contain only small quantities of ivory.

One organisation is currently proposing to support a 20% de minimis exemption for all musical instruments, although this concession curiously falls to just 5% for antiques.

It is reassuring to know that, despite some emotive language and imagery, there are sensible heads on both sides. A key interest of many supporting the ban is to ensure new ivory never becomes mixed with old.

“An ivory registration scheme does seem to be a workable if imperfect solution

A registration scheme – one that would provide licences for approved objects of ‘cultural, artistic, and historical importance’ (whatever that potentially problematic phrase may mean in practice) – does seem to be a workable if imperfect solution.

Imperfect, because to charge a fee to document each and every ivory transaction will render many worthy but modest Georgian and Victorian items effectively worthless.

Compensation unlikely

Furthermore, we believe owners and dealers in antique ivory should not bank on any suggestion of compensation to those who may lose out financially.

Letter openers, chess pieces, card cases, crochet bobbins, sets of fish knives, marrow scoops and so on will be without a marketplace – and, worse still, thrown away.

There will also be occasions when the masterful netsuke that a local auctioneer had deemed a mere trinket, or the 17th century baroque carving of a mother and child dismissed as a later copy, will also bite the dust.

Most tragically, the current elephant populations are unlikely to benefit from these restrictions.

That’s not because the success of such a scheme will depend on rigorous policing of all those lots described in euphemistic ways as ‘ox bone’, ‘faux ivory’, ‘composition’, and so on. It’s because there is no link between those who love and buy antiques and modern poaching.

Ultimately the government would do well to remember that the key letter in the acronym CITES is T for trade. CITES is not about banning the sale of objects that contain plant and animal parts. It is about proper regulation, fairly and evenly administered.

Happy anniversaries

The art market revels in celebrating milestones and this year two anniversaries will be marked in ways that can only be good for business.

BADA at 100: going solo

BADA CEO Marco Forgione, BADA president Victoria Borwick, dealer Michael Cohen (BADA chairman) with BADA events director Madeleine Williams at their Christmas party 2017.

As it celebrates its centenary this year, BADA recognises the parallels between those challenges that brought it into the world in 1918 and the issues that dealers face today. “BADA was created 100 years ago to battle government legislation on tax and 100 years later, the trade is still having to fight the good fight,” notes Marco Forgione, the association’s CEO.

Last year’s talk of merger with LAPADA has quietened for now, not least because the latter body has a new chief executive, ex-Tatler publisher Patricia Stevenson, who, early signs suggest, is determined to ensure that LAPADA ploughs its own furrow.

“Last year’s talk of trade body merger has gone quiet

In the meantime, the trade would expect any BADA anniversary celebration to be laden with nostalgia. There will indeed be the requisite reminiscing at dinners and events, and a publication celebrating BADA members’ centenary of dealing. At BADA’s fair in Duke of York Square, Chelsea, on March 14-20, two leading decorators will showcase fine objects in contemporary settings.

Back and forward

“We’ll be looking back and celebrating where we’ve come from,” says Forgione. “But more importantly we’ll look forward to see where the opportunities are as we seek to grow into the next 100 years.”

Better use of technology to link buyers with BADA sellers will be a focus. First out of the stocks is a relaunch of the association’s online platform, which Forgione vows will be “more powerful and more aesthetic, putting the objects at the forefront of the engagement with buyers”.

A heavy schedule of promotion and advertising of the platform is planned throughout the year.

“We should take this opportunity to show why Chippendale is the most important name in English furniture

Chippendale at 300: focus on craft

The tercentenary of the birth of Britain’s most famous furniture maker, Thomas Chippendale (1718-79), will cast some much-needed light onto fine English furniture.

The Chippendale 300 initiative kicks off with Thomas Chippendale: A Celebration of British Craftsmanship and Design 1718-2018 at Leeds City Museum (February 9-June 10).

There will be a range of events at country houses that hold Chippendale works including Burton Constable Hall, Dumfries House, Firle Place, Harewood House, Newby Hall, Paxton House, Temple Newsam, Weston Park, Harewood House and Nostell Priory.

A Chippendale armorial armchair from Weston Park in Shropshire, lavishly refurbished in the 1760s by Sir Henry Bridgeman.

It is perhaps too much to hope for a turnaround in fashion, but this unprecedented focus on one aspect of the decorative arts can only be a positive.

Dealer James Rolleston, of the Rolleston gallery in Kensington, sees the tercentenary as an opportunity to re-establish the difference between good and exceptional pieces of English furniture.

“Today, the media and auction houses often group collecting disciplines together under a very broad umbrella,” he says. “The value and appeal of a great Chippendale mahogany breakfront bookcase is not aligned to the value and appeal of a provincial Victorian bookcase and vice-versa. They cater for different tastes and budget.”

Market benefit

Guy Apter at west London dealership Apter-Fredericks says Chippendale is the most important name in English furniture and “it is essential that we take this opportunity to illustrate why. So many people are seemingly blinkered to the past. If these tercentenary celebrations can spark the public’s imagination and their appreciation for great craftsmanship, then the market will inevitably benefit.”

Both Rolleston and Apter-Fredericks will offer several pieces of Chippendale alongside a raft of other dealer shows and events planned for 2018.

While no-one is expecting a return to the heyday of antique furniture buying, the tercentenary has the potential to raise the profile of good English period furniture, and inject some fresh pride into the public consciousness along the way.

Online future: In brands we trust

“The great thing about the online-only space is that you’re not tied to the practicalities of holding a live auction,” says Samantha Phillips, Christie’s global head of digital sales for Asian art. “But you do need to be flexible, adaptable to your consignment flow and know where and what type of property is coming in.”

Trust issue

Established names count for much in the continuously evolving area of online-only sales, generating both consignments and trust. As shown by Berlin-based Auctionata’s demise last year, it has been tricky for relatively new players to get a foothold.

“The trust in the brand sets us apart in the online space where there are a lot of start-ups or smaller businesses that haven’t developed the strength and global reach that we have,” said Phillips.

As confidence grows in the online model, higher-value lots will migrate online. “Over the last year, we have seen the average lot value increase and I would expect, looking to 2018, that would continue,” says Phillips. “Our clients are becoming increasingly confident and they are not shying away from spending a reasonable amount online for something they want.”

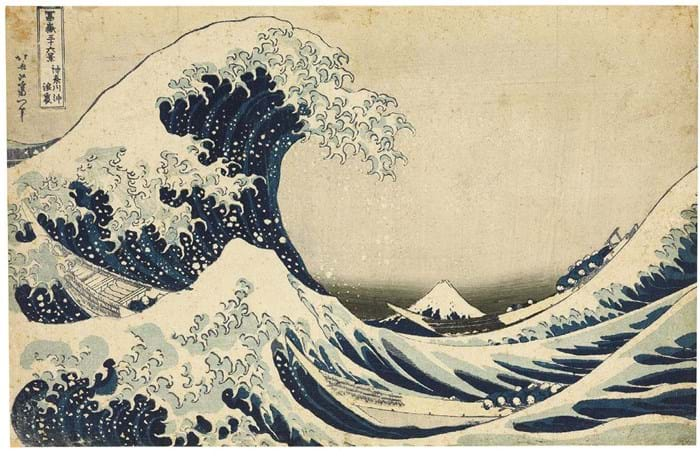

This version of Katsushika Hokusai’s Great Wave print sold for $180,000 in a Christie’s online sale in November titled Edo to Post War: 500 Years of Japanese Art and Design. Image copyright: Christie's Images 2017.

For dealers, e-commerce has been slower to take root, principally because they do not have the same level of resources and digital awareness as mainstream retailers. Although the vast majority of established dealers now have a website, directing traffic to it remains a difficult and costly exercise, according to silver specialist Michael Baggott.

Social media, in particular Instagram, has become an effective way to bypass this problem. This visual platform, which has been embraced by the art world, presents a potential wealth of new customers from shoppers to museum curators.

With the clever use of sophisticated photography and an understanding of how digital audiences shop, dealers are wising up to the challenge of translating an object, typically needed to be seen in the flesh, into the online space.

“Over the last year, we have seen average online lot value increase

The appeal of running a business with next to no overheads and only a smartphone will only grow as the next generation comes through, says Baggott. “Dealers can buy a piece of stock, instantly upload a picture of it on Instagram, and within an hour have sold it and be paid. Surely that’s the antique dealer’s dream?”

Engage with Instagram

Marco Forgione, chief executive of the British Antique Dealers’ Association, concurs. “I cannot stress strongly enough how everyone involved in this industry has to engage with Instagram,” he says.

In 2018, Forgione says we should expect to see the art market’s accelerated use of social media platforms as retail environments.

To prove his point, Forgione points out how Chinese social media app WeChat, already a key retail platform, is now a place to buy and sell art and antiques.

Buyer trends: Top category tips for 2018

As with any strong market, when the supply of good-quality material begins to diminish, prices for the best examples increase.

In the case of the Modern British art market, which has undergone sustained growth for over a decade, those priced-out individuals are looking to invest elsewhere, says Philip Smith, head of design at Mallams.

An area Smith tips to do well in 2018 is studio glass. The prices for leading artists of the studio glass movement in Britain, such as Samuel Herman (b.1936) and the late Michael Harris (1933-94), are already creeping up.

America first

“You look to America, and how American glass is now making serious money, with the likes of Dale Chihuly (b.1941) and other glass artists,” Smith says. “It hasn’t taken off like that in the UK yet, but maybe it will become an area which could start moving seriously in 2018.”

Textiles is another flourishing area of 20th century design. Works by the British artist weaver Peter Collingwood (1922-2008), Lucienne Day (1917-2010) and the British artist John Piper (1903-92) are still affordable but on the rise, and have been boosted by the attention they have received in several recent dealer exhibitions.

While it’s been another strong year for studio pottery in general – Woolley & Wallis closed out the year with some record-setting bids for Jennifer Lee and James Tower – the so-called ‘brown pots’ from the Leach school of early studio ceramics have softened. “Not only are there too many pieces on the market, the generation who did collect that sort of studio ceramics are dying off. They also don’t lend themselves so much to the modern living space,” says Smith.

Dawson’s Design at Home sale on December 2 included this 16in (39cm) hot worked glass vase by Samuel J Herman (b.1936) that sold at £1800. It was among a small number of pieces Herman made at Loco Glass in Gloucestershire from 2015-16 and entered for sale by the artist himself.

Arts & Crafts silver could be in for a good year, says Christopher Lanigan-O’Keeffe, silver specialist at Tennants in Leyburn. “It is an area that has always been popular, but I am increasingly confident when consigning an item for sale that it will make good money. Traditional silver collectors are paying more attention to Arts & Crafts pieces.”

Elsewhere, big-name vintage watches by makers such as Rolex and Patek Philippe, stones (particularly diamonds), mid-century modern furniture and vintage posters will continue to thrive, driven by demand from young professionals. These areas are expected to go “from strength to strength”, says Lee Young, recently appointed managing director at Duke’s in Dorchester.

Technology: Innovation in e-commerce

For all the hype around technology, human behaviour dictates it isn’t adopted as fast as we might expect – especially when it comes to the art and antiques market.

Yes, the buying of art and antiques online is now well established, thanks to the success of platforms such as thesaleroom.com (a sister company to ATG), 1stDibs and the dealer associations’ own portals.

But where next for art market e-commerce? The answer partly lies with a new generation of digital-native, smartphone-armed auctioneers, dealers and buyers.

It also lies in the example shown by big home interiors retailers such as Ikea – with whom the lower and mid-priced end of the antiques market competes.

Home comforts

Which is why, for our 2018 technology prediction, ATG is placing a bet on so-called ‘augmented commerce’ and its ability to help prospective buyers place objects in their home setting, using a smartphone camera.

In the past year Ikea and Amazon have both launched augmented reality (AR) apps, and where these giants set the trend, buying behaviour is sure to follow.

Imagine the convenience for shoppers at fairs from Ardingly to TEFAF to be able to picture objects – small and large – in the home before committing to purchase?

ATG hears at least one dealer association is looking actively at augmented commerce, suggesting it may hit the art and antiques market in the next 12 months.

Fees to buyers: Under pressure

In a matter of days new rules will mean an end to all credit card surcharges, thanks to an EU directive known as PSD2 coming into force in the UK on January 13. It raises questions as to whether auctioneers and dealers will absorb the cost of credit card transactions or pass them on to buyers in another form.

For auction houses, this may mean a hike in buyer’s premium, says auctioneer Adam Partridge.

His auction house’s premium is currently among the lowest of the larger regional salerooms at 15% but Partridge says he may have no choice but to charge more.

“Having a low buyer’s premium is better for both vendors and buyers, as it should result in better hammer prices, but the end of credit card fees could mean it is raised.”

The EU directive known as PSD2 comes into force in the UK on January 13 meaning business will no longer be able to make credit card surcharges.

Another suggestion is to refuse credit cards altogether – a tempting proposition given that fraudulent chargebacks have been the scourge of the industry for years. But, refusing to accept them would be impractical and inconvenient for some valued customers.

Growing expectations

For Lee Young at Duke’s in Dorchester, it is more the growing digital demands and the guarantees that auction houses provide today which will force premiums up in the future.

“I think current buyer’s premiums reflect the level of service and expertise that auction houses provide today for their clients,” he says. “But as the digital world evolves and our clients expect more and more, we will have to look at ways to capture that expenditure.”

Sworders chairman Guy Schooling agrees. “Auctions are now mainstream in a way they were not with the general public 20 years ago, so we will all have to work harder to meet growing expectations,” he says.

“As a result, first-class specialist knowledge will come at even more of a premium in building client confidence among buyers and sellers.”

GDPR 2018: Don’t panic

Vendors and buyers’ desire for privacy has long been a feature of the art market. At the shop-floor level, this includes how dealers and auctioneers use customers’ personal data – postal and email addresses, telephone numbers, buying behaviour data and so on – as guided by current, 20-year old legislation.

In 2018 those protocols will be substantially revised to give customers more control over their data in the digital era, with particular implications for how auctioneers and dealers use this data for direct marketing purposes.

This happens on May 25 when the EU General Data Protection Regulation (GDPR) is implemented in the UK. Unlike the uncertainties around leaving the EU in March 2019, there is clarity on what dealers and auctioneers need to do in order to comply.

Simon Stokes, partner at Blake Morgan LLP and a solicitor who acts for art market clients, sums this up as “doing due diligence on the way you have collected existing data and being more transparent in how you use it”.

Email marketing to existing clients is currently covered by a ‘soft opt-in’ exemption but all firms, including auctioneers and dealers, will need to update their overall policies and procedures in handling customer data if they haven’t done so already.

‘Still time’

Are auctioneers and dealers ready for the new rules?

With so much business red tape to contend with, it’s likely some have yet to put GDPR on their radar. However, Stokes says, “there’s still time to get the building blocks in place”.

As a first port of call, Stokes urges businesses to read government GDPR advice and use toolkits at ico.org.uk and ignore media scaremongering and software supplier hyperbole, “hard though that may be”.

In preparation for GDPR, “the best advice is to comply with existing law as a starting point”, Stokes says. Firms such as Fellows Auctioneers have told ATG they do so as a matter of policy, in particular relating to how data is stored and the use of that data for marketing purposes.

New Data Protection regulations will be implemented in the UK on May 25.

“The current legislation requires us to be registered with the Data Commissioner and to appoint a data controller – we fulfil these requirements,” says Stephen Whittaker, managing director at Fellows.

“Most importantly we invite the registrants on our website to sign up for any subsequent communications or email alerts and they can opt-out at any time.”

Fair dealing: Filling in the gaps

For many dealers, despite the power and reach of online, fairs will remain the lifeblood of their business in 2018. Rising rents and business rates, especially in London, and the fact that some smaller dealers also have a ‘day job’, or simply don’t want to spend their time running a shop, mean that fairs are the main way they will continue to promote their business and sell their stock.

Robbie Timms, who runs S&S Timms Antiques, dealers in 17th-19th century furniture, with his father Steve, says: “Fairs are hugely important to our particular business, and always will be. Without a shop it is the best way of putting ourselves in front of new people while being able to actively engage with them and get to know them, which of course is absolutely impossible online.”

He adds: “No matter how much business is done online, there will always be an important place for fairs in our business as a way of directly interacting with clients and potential clients.”

S&S Timms has exhibited at more than 150 events over the past 30 years, from boutique events at Harewood House, Esher Hall and The Mere to the major London events, including the Art & Antiques Fair Olympia, the LAPADA Antiques Fair and the BADA Antiques Fair. It is booked to exhibit at seven London and international events in 2018. Each fair, says Timms, “has its own unique qualities and different target markets”.

But now the probable loss of the winter Art & Antiques Fair Olympia may create a gap in S&S Timms’ and other dealers’ calendars. Historically falling between late October and early November, the event is likely to cease or if it does return, to run in truncated form alongside organiser Clarion’s Spirit of Christmas fair.

Mary Claire Boyd, director of the Olympia fair, says the organiser is presenting dealers with options, “with a view to making a decision within the first quarter of 2018” after receiving feedback.

Meanwhile the race is on to fill the possible breach, with one suggestion being that trade associations BADA and LAPADA may run a joint event.

Whatever happens, BADA has pledged a reworking of the classic fairs model. It’s set to reprise its boutique collectors’ event, BADA Collection, launched last year in the Lanesborough Hotel in Hyde Park Corner, and CEO Marco Forgione intends to expand this model with other events.

Regulations: Art market in the spotlight

A tug-of-war has long existed in the art and antiques trade between the need to be deemed professional and transparent on one side and the desire to avoid red tape on the other. The calls for regulation are currently shouting loudest.

Golding Young & Mawer Auctioneers managing director Colin Young, who took over the NAVA Propertymark presidency in 2017, is a firebrand on the issue. He told ATG: “All auctioneers and valuers should be members of a professional body. There are too many auctioneers who are not regulated and not qualified.”

Client accounts

The issue of separate client accounts for auctioneers reared its head once more in 2017 as Cobham, Surrey, firm Fryer & Brown went the same way as Auction Atrium and Cameo before them, leaving vendors unpaid.

Consigning items to public auction will always carry an element of unpredictability but it should never be a risk.

Good luck to those buyers and consignors who, via the power of modern technology, are coalescing to work together to pursue Fryer & Brown for what they are owed.

When LAPADA’s outgoing chief executive, Rebecca Davies, and Dr Scott Steedman, director of Standards at the British Standards Institute, took to the stage at September’s Art Business Conference, they too called for better industry benchmarks. With Davies’ move back into the contemporary art world, we wait to see what priority the industry gives to this initiative.

Yes, there are countless regulations from money laundering to data protection that now impact on business, but the desire to improve the image of the trade is key. A lack of transparency in the art and antiques market was cited by 75% of wealth advisers as their primary concern in the Art & Finance Report 2017 by Deloitte Luxembourg and ArtTactic.

In short, if the industry doesn’t begin to get its house in order this year, then there may be those outside who will seek to do it for them.

“There are countless regulations from money laundering to data protection, but the desire to improve the image of the trade is key