The online lending platform, founded in 2014, facilitates peer-to-peer lending, allowing individuals to borrow against the value of their personal assets such as luxury watches, cars, fine arts, antiques, jewellery and gold.

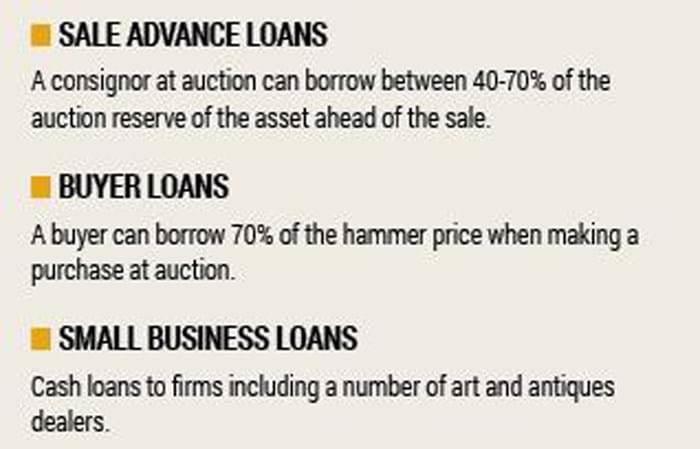

Co-founder Rito Haldar said around 25% of its customers are small business owners with a number of dealers and auctioneers now using the service. Companies now offering Unbolted products include Forum Auctions, Fellows, Lyon & Turnbull, H&H Classic Cars, Barons Classic Cars and IG Wines.

Halder said: “We provide continuous financing for working stock. For example, we will hold £100,000 of watches for a loan of £80,000, but we will allow the dealer to swap in and out watches from the stock as they get sold. In some cases where necessary we will allow stock to be kept in showrooms and shopfronts.”

Dealer Chris Brown, owner of Fitzrovia Watches, has been working with Unbolted since last year.

He said: “Stock costs money and banks are not willing to lend on stock like that anymore. I use funding to buy packages of watches from clients. It is liquidity to grow and help customers rather than a need borne out of hardship.”

Interest rates charged on loans varies from around 9.2% to 19% (APR) for auction related loans to between 15-18% (APR), or around 1.25-1.5% a month, for small business loans.