A brief look at the overall totals for the biannual auction series that take place in London in December and July indicates the ups and downs in terms of activity in this sector. The rises and falls, however, are less to do with changing tastes or large numbers of new players entering or leaving the sector (although both are long-term factors) but more reflect simply the overall quality and quantity of what the salerooms can source.

Supply at the latest round of sales was relatively favourable, reflected in the £98.1m (including premium) generated at the July Old Master auctions. The combined figure at Sotheby’s, Christie’s and Bonhams exceeded the £92.8m from the equivalent series last year and was slightly above average for the sector in terms of results posted over the last decade.

One or two Old Master supporters may even have had a wry smile as these figures held up at a time when the Impressionist & Modern and Contemporary totals suffered a drop of over 20%.

Lion’s share

This time around, Sotheby’s had the lion’s share of the top consignments and grossed £67.8m across its evening and day sales, eclipsing Christie’s £29.1m. The latter suffered from the slimmer pickings on offer, especially at its evening sale.

Sotheby’s evening sale on July 3 posted a £56.7m total, which was the firm’s third highest for an Old Master sale in London and 32% up on the equivalent sale last July.

The auction house succeeded in gaining consignments in part by upping its practice of arranging ‘irrevocable bids’ from third parties. These guarantees applied to 11 lots in the 37-lot sale. While this strategy appears to have helped secure the prize works for this series, it drained some of the energy in the room on the night as a number of works failed to draw much bidding and sold either on low estimates or towards the lower end of expectations to their respective guarantors.

Before the sale, there were encouraging noises about a rare canvas by Johann Liss (c.1595-1631) – the first major painting by the artist to appear since the same work sold for £900,000 at Christie’s back in December 1994, a price that still held the auction record.

The German painter’s travels across Europe meant he developed a highly individual style that Sotheby’s specialist Andrew Fletcher described as a “melting pot of early Baroque from northern Europe, Caravaggist drama and Venetian colouring”.

While few works by Liss now remain in private hands, The Temptation of Saint Mary Magdalene (pictured in News, ATG No 2400) was in “amazing condition”, said Fletcher. According to The Daily Telegraph, it was one of five works in the sale consigned by furniture magnate Graham Kirkham, all of which had catalogue symbols denoting they had third-party guarantees.

The vendor had acquired the Liss painting the year after the 1994 auction and it appeared here with a £4m-6m estimate. Even though it drew lukewarm bidding, the seller’s expectation of a considerable return was surely realised when it was knocked down at £4.8m to the Metropolitan Museum of Art in New York, breaking its own auction record.

Although the vendor’s 1995 purchase price is not known, this represented growth of over 10% per year since the 1994 auction result, accounting for inflation – a credible case for those who argue that high-quality Old Masters are a good investment.

The Gainsborough market

Another of the Kirkham pictures was a Thomas Gainsborough (1727-88). Going To Market, Early Morning was described by the auction house as “arguably the artist’s finest masterpiece remaining in private hands”.

The 4ft x 4ft 10in (1.22 x 1.47m) oil on canvas had been known as ‘the Holloway Gainsborough’ having belonged to Royal Holloway College in London since the 19th century. Kirkham acquired it from the college in 1993 for a reported £3.5m.

Its earlier provenance was impressive. It had been purchased from the artist by his banker Henry Hoare (1705-85), descending through the family at Stourhead in Wiltshire before selling in 1883 for a remarkable 2700 guineas at Christie’s auction of the estate’s heirlooms (it outsold works by Rembrandt and Poussin in the same collection five-times over).

Here it was estimated at a hefty £7m-9m, above the existing auction record for Gainsborough which stood at £6.6m (including premium). With its third-party guarantee, it was always bound to sell on the night but, after failing to ignite interest in the room, it was knocked down on low estimate to a commission bidder represented by George Wachter, Sotheby’s New York-based co-chairman of Old Master paintings worldwide.

Despite the picture making an artist record, here the sofa king appears to have made a real-terms loss on the 1993 sum (equivalent to £7.12m in today’s prices).

The Gainsborough jointly led the Sotheby’s sale and the Old Master series along with another British picture sold at the same auction.

Turner gift

A late work by JMW Turner (1775-1851), a Surrey landscape that was once owned by the banker JP Morgan, was estimated at £4m-6m and drew a number of bidders before it was knocked down on the phone at £7m.

Consigned from a private Japanese collection where it had been for around 35 years, Landscapewith Walton Bridges was one of the few works by Turner that had left his studio and was therefore not included as part of the bequest the artist left to the nation on his death (the works are now in Tate Britain).

Turner gave it to his landlady and partner, Sophia Booth, and it later appeared at Christie’s sale of her son’s collection in 1865.

The estimate may have seemed conservative for work by an artist who has made many times this level in the past, although there were some conditions concerns about the 2ft 11 x 3ft 11in (88cm x 1.18m) oil on canvas – such as the vertical lines of drying craquelure and scattered retouching – that may have limited the bidding.

Satanic scene

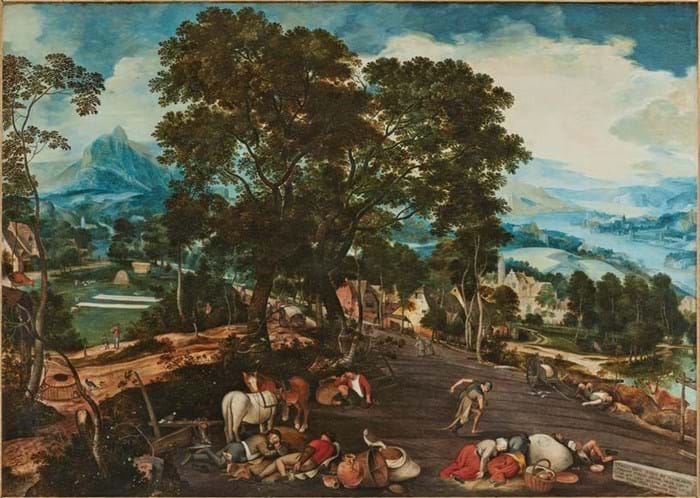

Elsewhere in the sale, one of the works bringing strong interest was an exceptionally rare and large oil on panel by Peeter Baltens (1527-84) titled Landscape with Satan sowing Tares. The Flemish artist, also called Custodis, is much less well known than his contemporary Pieter Bruegel the Elder, although the two painters had entwined careers and even collaborated on at least one project.

Fewer than 15 autograph paintings by Baltens survive and this 3ft 10in x 5ft 4in (1.17 x 1.64m) biblical landscape was billed by Sotheby’s as “unquestionably the finest left in private hands” and also “in remarkably good original condition for a work of 450 years old”.

Notable in terms of its art historical importance was the fact that, while other known works by the artist have clear similarities with Bruegel’s kermesse scenes, this work was a much sparser landscape with diverse terrain that represented a distinct move away from his fellow painter’s oeuvre. Indeed, the work dated to c.1570 – the year after Bruegel’s death and shortly after Baltens became Dean of the Guild of St Luke in Antwerp.

Incomparable to anything on the market for a long time, it overshot a £1m-1.5m estimate and was knocked down at £2.3m, seven times the previous auction record and again showing how demand will follow if the supply is right.