Billionaire businessman and art collector Patrick Drahi made a move last week via his BidFair USA company to take the auction house into private ownership after 31 years as a public company.

Shareholders would receive a premium of 61% on the value of their holdings at June 14.

If the deal completes it will mean the world’s two largest auction houses will both be privately-owned by French billionaires. Christie’s was bought by Francois Pinault’s holding company Artemis in 1998.

Great time to sell

Private companies are usually better vehicles for gaining market share, being able to offer more lucrative deals to potential consignors with less concern for profitability.

One source told ATG: “This deal could take the constraints off and may mean the market is a lot more competitive. If you are the owner of a blue-chip artwork this could well be a great time to sell. Depending on what strategy Drahi follows, we may see a huge increase in competitiveness between Christie’s and Sotheby’s.”

As a company listed on the New York Stock Exchange, Sotheby’s has been under considerable pressure to increase its margin on consignment deals.

Despite this, the company has expanded its use of guarantees in the last few years which led to a decline in commission margin reported in a financial update to Sotheby’s shareholders in August 2018.

More flexible

Chief executive Tad Smith said: “Private ownership at this moment in Sotheby’s development would empower us to accelerate many of those growth initiatives… in a more flexible private environment.

“Patrick Drahi is a knowledgeable businessman and a passionate collector who understands Sotheby’s. He shares our brand vision for outstanding client service and has the patience to make that possible.”

Sotheby’s strategic focus has also been on growing its luxury and Asian and digital market activity (see interview on page 34).

Whether this focus will continue for the longer term is not clear but in the short-term Drahi said there will be no change: “As the future owner, I have full confidence in Sotheby’s management, and hence do not anticipate any change to the company’s strategy. Management and their exceptional teams and talent around the world will continue to operate with my full support.”

The deal is due to complete by the end of the year but still needs full shareholder and regulatory approval.

In the meantime, it is possible that new bidder could still emerge to out-bid Drahi’s offer.

Guarantees

Irrevocable bids, also known as third-party guarantees, are when an auction house enters into an agreement to ensure that a work is sold at a minimum amount prior to its auction, either backed by itself (house guarantee) or by a third party, to entice consignors.

The third-party investors who enter into these arrangements then receive a windfall if the work sells for more. This means that the commission margin for the auction house reduces when the third-party guarantor takes a cut of the upside.

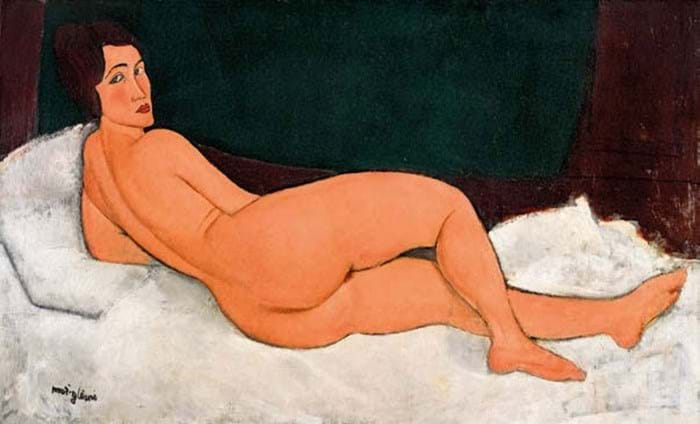

Amedeo Modigliani’s 1917 Nu couché (sur le côté gauche), was knocked down for $139m (£102.2m) at Sotheby’s New York in May 2018 – the fourth most expensive work of art ever sold at auction and Sotheby’s all-time record lot. But due to a third-party guarantee, Sotheby’s commission was greatly reduced.

Sotheby’s: a short history

1744 - Sotheby’s founder, bookseller Samuel Baker, held his first auction under his own name on March 11, 1744.

1780 - Known as Leigh & Sotheby after John Sotheby (Baker’s nephew) works alongside Baker’s original partner George Leigh. Sotheby’s descendants remained involved for another 80 years.

1861 - The last of the Sotheby family died and partner John Wilkinson took over.

1977 - Sotheby’s ‘went public’ with shares over-subscribed by 26 times

1983 - Alfred Taubman purchased Sotheby’s in 1983 for $125m.

1988 - Sotheby’s went public (again) and listed on the New York Stock Exchange (the firm became the oldest publicly traded company on the NYSE).

2000 - Investigations into alleged price-fixing and anti-competitive practices in the auction market. Taubman resigned as chairman of Sotheby’s.

2015 - Tad Smith was appointed chief executive officer of Sotheby’s

2019 - Sotheby’s sold to BidFair USA, a company owned by media and telecom entrepreneur and art collector Patrick Drahi.